How to calculate Airbnb income considering the property location, seasonality and time for investment? This article is designed to help short-term rental hosts and investors explain how different Airbnb revenue calculators work. From the basic revenue estimation to more sophisticated tools that account for additional fees and expenses – we’ll guide you through the nuances of revenue calculation.

DONT EDIT Not displayed 1st open tab

Table of Contents

- Online Airbnb revenue calculator

- How to make an accurate Airbnb revenue forecast

- Optimising Your Average Daily Rate (ADR)

- Maximising Airbnb Occupancy rate (OR)

- Boosting booking rates

- Seasonality adjustment for Airbnb revenue assessment

- Operating expenses in short-term rental business

- Approaching Net Income from a short-term rental investment

Simple Airbnb Revenue calculator

The basic short term rentals revenue formula is:

Number of units x Occupancy Rate x Average Daily Rate x Nights available = Revenue

Simple Airbnb Revenue Calculator

Annual gross booking revenue:

Annual gross booking revenue/unit:

- Number of units – rooms or apartments (listings) available for rent during a year.

- Occupancy Rate (OR) – the percentage of time your Airbnb is occupied by guests over an available rental period.

- Nights available – average number of days your listings are available for bookings during a year.

- Average Daily Rate (ADR) – the average rental income per paid occupied room in a given time period.

- Revenue – the total income generated from your short term rentals over a period

Example: If you charge $150/night and achieve a 52% occupancy rate, have 200 nights available to book, and 2 listings, that would mean you will make around:

0.52×$150×200×2 = $15,600 before expenses and taxes

How to get metrics for the Airbnb Calculator?

There are online resources available that provide data based on nearby properties, but it’s recommended to source from multiple places as these analytical tools do not cover all OTA channels.

- Borrow the average metrics obtained from our recent research on the 60 major locations in Europe.

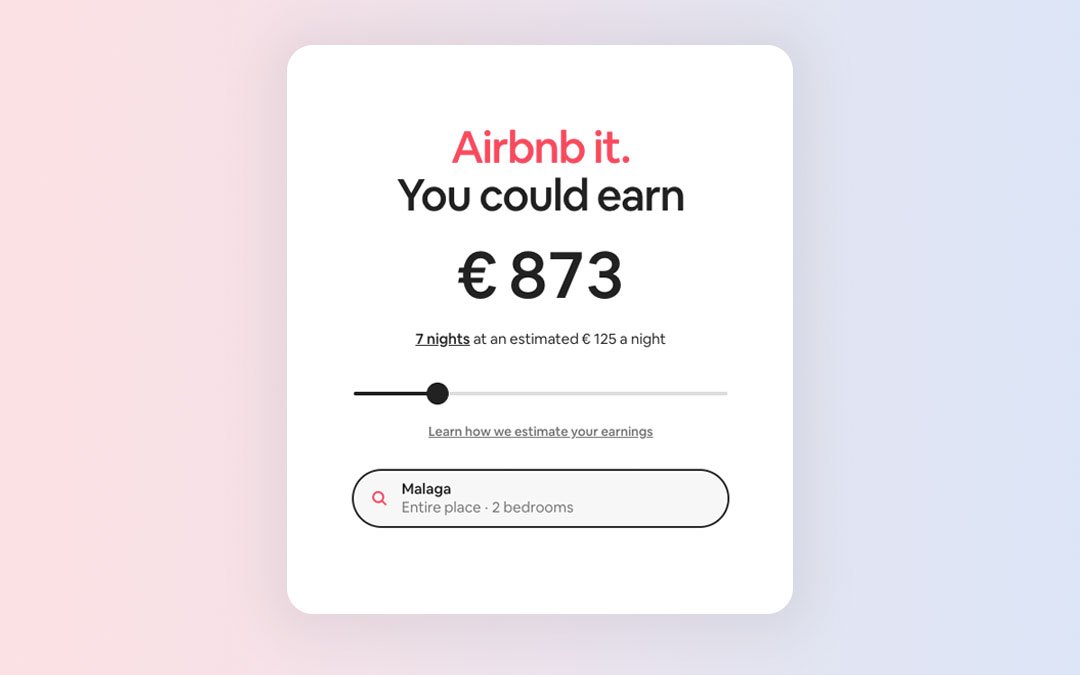

- Airbnb’s official revenue calculator – especially good for a quick price reference.

- Airbnb host app: local pricing tool and Airbnb Insights.

- AirDNA calculator – free tool, but may be biassed towards Airbnb and Vrbo in North America.

- Airbitics – basic free Airbnb analytics based on the location.

- Mashvisor – paid tool with predictions accuracy within 10% of actual results.

- PriceLabs – paid tool, predictions level is similar to Mashvisor’s.

How to make an accurate Airbnb revenue forecast

Let’s zoom in on every metric used in the short-term rentals revenue formulas. A good place to familiarise yourself with the revenue metrics is the Airbnb Insights tab, where you can find the most important ones:

Airbnb Insights tab in the host app

There are different ways to improve every metric, all of which are very interdependent in the end:

- Average Daily Rate (ADR): This metric shows how your property compares to local competitors in terms of listing and service quality. It also indicates the STR value of your property and the effectiveness of your pricing strategy. Strategic approach to pricing is key to guest bookings, and it’s essential to plan your rates 1-1.5 years ahead, taking into account the dynamic seasonal shifts in your locality. You can use features, like Your.Rentals Smart rates tool to help you set prices.

- Occupancy: Occupancy rate helps you understand if your pricing strategy is working effectively. Industry average occupancy is ±50% (with big fluctuations). A high occupancy rate indicates that your pricing is competitive and attractive to guests, while a low occupancy rate may suggest that adjustments are needed. At times, the occupancy is defined by the property’s location and type, such as a ski resort experiencing higher bookings during winter.

- Booking rate: It shows how often guests book your property after viewing it. A booking rate of 2-2.5% is considered okay, as it signifies guests’ satisfaction with your rental listing description, photos, and pricing. Essentially, this indicates that your listing is well-positioned in the market. On the other hand, a lower rate may indicate issues with your positioning, your price or service quality.

- Potential Income: this metric helps you determine if you are reaching your annual income targets and if a property is worth investing in.

- Revenue Per Available Room (RevPAR): it represents the average revenue generated per night for your property based on its projected occupancy and pricing.

By analysing these metrics, you can make data-driven decisions to improve your rental business, increase customer satisfaction, and achieve your financial goals.

Additional factors you need to consider when planning:

- Seasonality adjustment: defining the low and high seasons makes your revenue forecast more realistic. To account for seasonality, you can use historical occupancy data or insights from local tourism trends to adjust your RevPAR (revenue per available room) estimate for different months or seasons.

- Operating expenses: operating expenses include costs associated with maintaining and managing your property, such as furnishing, cleaning, utilities, video and noise monitoring, repairs, and channel fees. Consider these expenses when calculating your net income.

- Investment horizon: The investment time frame impacts the profitability of your Airbnb venture. Short-term rentals may generate higher returns in a shorter time frame, while you still need to pass the profitability point in the first months.

Optimising Your Average Daily Rate (ADR)

The Average Daily Rate (ADR, aka Average Nightly Rate) is the average income generated per day for a single reserved room. When making an Airbnb booking, this is one of the key factors that is given significant consideration. To calculate ADR you divide the total bookings revenue by the total number of nights booked.

ADR = Total Revenue / Number of Booked Nights

Suppose your total revenue for a month is $5,000 and the total number of booked nights in that month is 25, the ADR = $5,000 / 25 = $200 per night.

ADR shows you how much people are willing to pay to stay at your rental, providing insights into pricing strategies and market demand. It also strongly reflects the quality of your rooms, customer service, and overall value for the money.

How to find out ADR?

The easiest way to check the average price for Airbnb is to use Airbnb’s pricing tool in the app. Just login to your host account, and when you select an individual listing price there’s an option to check the price level around your location.

Airbnb price tool shows local competition

Alternatively, you can also start by estimating the revenue and the number of nights booked. Revenue prediction could be based on some existing data, for example, AirDNA reports or our research of the major travel cities in Europe.

Next, you estimate the number of booked nights per month. Based on the average market occupancy of 65% in a good scenario it is 30 x 65% = 19,5 nights. So, If you’re in Malaga, Spain your ADR will make:

ADR = 2032 (Revenue per month) / 19,5 (nights per month) = €104.2

Strategies to improve the price of listing (ADR)

The average daily rate is actually the listing’s price tag for a particular day. For a higher rate, you need to improve the guest value of your short-term rental experience.

To boost your ADR, improve your listing quality, by bringing in quality photos, keep updated descriptions, and all possible amenities (bunk beds!), and more 5-star reviews, as these influence perceived value.

Additional activities raising the perceived listing value:

- Break down the booking year into seasons – high, low or special local events.

- Adjust prices for midweeks and weekends (usually higher). For rate estimation, utilise tools like Your.Rentals or Airbnb pricing tools in the app.

- Unblock more dates, as availability is a huge factor on Airbnb.

- Offer exclusive amenities, give value on top of competitors.

- Introduce Welcome Packs: a gesture to impress your guests and create a memorable experience from the very beginning of their stay.

- Check-in and check-out experiences: work on house instructions, help with the luggage, local guide, etc.

Larger or luxurious accommodations, unique features, and extra amenities can justify higher rates. As you gain experience and provide guest value, your ADR naturally increases.

Use Dynamic pricing for ADR optimisation

You may have come across the concept of listing price automation – dynamic pricing.

It’s a general guideline for Pro-hosts to use a price automation tool like Pricelabs. However, it usually comes with a cost, which may deter newcomers from utilising them at the outset.

Dynamic pricing essentially takes full control of your pricing with real-time adjustments based on algorithms.

Smart rates for short-term rental listings

There’s a free-to-start alternative to costly dynamic pricing subscriptions – the Smart rates. Smart rates are available to anyone with Your.Rentals account (which is subscription free, you only pay a fee per booking).

Smart Rates is an intelligent pricing strategy for short-term rentals, utilising real-time market data and machine learning-based predictions to adjust prices based on factors like demand, supply, events, seasonality, and weekdays/weekends.

Smart rates enabled for a listing at Your.Rentals

Smart rates are particularly advantageous for property owners with multiple listings. While it doesn’t guarantee higher income, it increases the likelihood of bookings and steady revenue flow.

Smart Rates are embedded in Your.Rentals app and are free to use. With it, you have the freedom to choose your pricing strategy – whether it be maximising revenue over occupancy or vice versa. You can set the minimum rate and let the system adjust the prices automatically for you.

Maximising Airbnb Occupancy rate

The average occupancy rate is calculated by dividing the total number of booked nights by the overall nights available for booking across all relevant listings.

Occupancy Rate = (Number of Booked Nights / Total Available Nights) × 100

If your property has 20 available nights in a month and 15 of those nights are booked, the Occupancy Rate = (15 / 20) × 100 = 75%.

It’s crucial data as it shows whether a property’s pricing strategy is working, or if the listing’s quality is up to standard. If the occupancy rate is significantly lower than the average in the area that would indicate a problem.

What influences the Airbnb Occupancy Rate

At Airbnb the occupancy rate is influenced by the local short-term rentals competition, and tourism seasonality.

That’s why in big tourist attraction cities like New York there is a higher and steadier occupancy rate than, for example, Jacksonville; or why demand surges in areas during events, like Somerset during Glastonbury Festival. Generally, a good occupancy rate is considered to be 50% or higher, depending on the specific conditions of your property.

Fun fact: Taylor Swift’s European tour 2024 (48 cities in 14 countries) is expected to have a significant impact on the occupancy rates for short-term rentals in some cities: Vienna – 1,989% year-over-year demand increase, Warsaw – 2,020% year-over-year demand increase (data by Airdna).

Pro Tip: Use as many travel channels as you can apart from Airbnb. With Your.Rental, you can get listed on more than 50+ channels. This wide exposure means more chances to get booked, and brings in guests from all over the world.

RevPAR: a revenue metric based on ADR and occupancy rate

RevPAR (Revenue Per Available Room) is the product of ADR and occupancy rate.

It represents the average revenue generated per night for your property based on its projected occupancy and pricing.

RevPAR = ADR x Occupancy Rate

Some analytical platforms like AirDNA use RevPAR as one of the main metrics. But as an Airbnb investor you should strive to go beyond RevPAR, since there are things like revenue streams, net income and overall profitability that you might want to forecast from day one.

RevPAR encompasses fundamental market metrics

Boosting booking rates for higher income potential

Booking rate, or conversion rate, is a good indicator of how good your listing is converting views on search results pages of Aribnb and other channels into booking requests. It is calculated by dividing the number of bookings by the total number of views the listing receives.

Booking Rate = (Number of Bookings / Number of Listing Views) × 100

If your listing receives 1,000 views and 50 bookings, that would mean your Booking Rate = (50 / 1,000) × 100 = 5%.

Pro tip: to check the number of listing’s views on Airbnb go to Insights tab > Conversion > Views, where you’ll be able to adjust the time period.

How to boost your booking rates

According to Airbnb, there are two most important factors that affect conversion rate – Pricing and Quality.

Pricing

It’s essential to adjust your pricing strategy to seasonal demand, local events, and market trends to attract more bookings. Your.Rentals simplifies this process with its Smart Rates feature, You can really free yourself from the tedious task of continuously monitoring and updating Airbnb tariffs.

Listing quality

Airbnb is a crowded marketplace. High-quality is a must have if you plan to play the short-term rentals game in 2024. The major improvement point are quite well known:

- Improved listing photos

- Descriptions update and enhancement

- Aim to get more positive reviews (4.6 and higher)

- Focus on niche traveller profiles and provide amenities for them: workspace for business travellers, restaurant coupons, self-check-in options, or family-friendly items and more.

Some tactical ideas to maximise your booking rate:

- List on multiple channels/platforms: Expand your reach by listing your property on various channels and platforms. This broader exposure can attract a diverse range of guests, increasing your chances of bookings. With a single account on Your.Rentals you can get booked on 50+ channels.

- Increase the number of listings: If you have multiple properties, consider listing them separately. This can increase your overall visibility and appeal to different guest preferences.

- Leverage social media: actively promote your property on social media platforms. Share engaging content, special offers, and positive guest experiences. Social media can be a powerful tool for attracting potential guests and encouraging direct bookings.

- Direct bookings: encourage guests to book directly through your website or preferred platform. This not only saves you from channel commissions (typically 15%) but also allows you to establish a direct connection with guests. This can lead to repeat bookings and positive reviews, which in turn increases your booking rate.

- Use Promotions: take advantage of promotional tools, such as offering exclusive discounts or coupons. Platforms like Your.Rentals may provide promotional features that entice guests to choose your property.

- Encourage return bookings with Coupons: offer special discounts or coupons through Your.Rentals to guests who choose to return. Building a base of returning guests can contribute significantly to your property’s overall success.

Find the balance between views, booking rate, and reviews. A lower conversion rate may be attributed to a high number of views without subsequent bookings, but it doesn’t necessarily indicate a negative outcome as you could be fully booked.

Easy way to start Airbnb business

Your.Rentals is here to assist you build great vacation rental listings on 50+ channels.

Seasonality adjustment for Airbnb revenue assessment

As an Airbnb host, you aim to optimise your property’s revenue potential throughout the year. This means that you need to cross-reference yearly averages with monthly OR, ADR, and Revenue trends, and make adjustments based on your local market.

Here are some strategies to do this:

- Reiterate Airbnb analytics to analyse booking patterns and average rates across different seasons.

- Consider local events and celebrations. Get the full list and gain insight into demand surges and probably create seasonal rates for peak times.

- Track weather patterns and peak travel times, such as vacation periods and school holidays.

- Plan in advance for the Low seasons. Decide how low you can go with the price, or does it make sense to block some dates. Think of possible promotions during that season.

- Analyse your cyclical guest preferences. This way, you can stay one step ahead and offer what guests are looking for and adjust your listing description.

- Be active on social media channels and travel forums. These platforms are where travellers often share their experiences and planning preferences, giving you valuable insights into guest expectations.

By adopting these practices, you’ll be well on your way to more accurate pricing and occupancy rates predictions for your Airbnb.

Operating expenses in short-term rental business

Here’s the essential expenses for hosts and property managers in the vacation rental business:

- Property management fees: in case you need help with the property management, count for 10% – 20% of rental income for services like guest communication and maintenance.

- Cleaning and maintenance expenses will vary with property size and necessary repairs.

- Utilities: electricity, water, and gas, are variable costs.

- Local taxes and fees: diligently track for compliance with local regulations, including Spanish Guest registration.

- Marketing costs, like online advertising and website (check Your.Rentals direct booking option).

- Essential amenities and furniture like work desks, Wifi fee, bunk beds, cribs, kitchen appliances, etc.

- Occasional costs for professional services such as pest control and landscaping.

- Insurance coverage including both host liability and property damage insurance (get to know about Aircover coverage).

- Vacation rentals software: channel manager, dynamic pricing, guest communication, etc. fees can make 5 to 30% of the rental income, depending on the functionality and the number of units.

Approaching Net Income from a short-term rental investment

Let’s build together the steps to getting the Airbnb investment opportunity assessment.

- Estimate your Gross Rental Income using our Simple Airbnb Revenue calculator. There are free tools such as Airbnb’s “What’s my Place Worth” to help you.

- Make seasonal adjustments to your rates and nights available per year. Explore trends and demand patterns in your particular region. Take into account a loss due to vacancy.

- Calculate Effective Rental Income by factoring in the vacancy rate.

- Scrutinise operating expenses: channel fees, taxes, utility costs, insurance, and maintenance costs. For rental investment numbers see this post.

- Calculate Net Operating Income (NOI) by subtracting operating expenses from effective rental income. NOI=Effective Rental Income−Operating Expenses

- Calculate potential Net Income. If you plan to take a mortgage, deduct the annual debt payment. Net Income = NOI−Annual Mortgage Payment.

- Calculate ROI (Return on Investment). ROI = (Net Income/Total Investment)×100

This comprehensive approach, considering both income and expenses, provides a more accurate projection of the short-term rental property’s financial potential.

Conclusion

In conclusion, tools like Airbnb calculators, Airbnb insights, and others assist in gathering essential data. However, basic calculators have limitations, and advanced tools analysing financial indicators provide more accurate forecasts.

Metrics like ADR, Occupancy Rate, Booking Rate, Potential Income, and RevPAR guide hosts in optimising performance.

Strategic pricing, dynamic tools like Your.Rentals’ Smart Rates, simplifies rates management and maximises booking opportunities.

Creating an investment plan is highly recommended. I will allow you to plan your finances and evaluate the progress of your investments on a monthly basis.

Our Airbnb Revenue spreadsheet aims to help you set appropriate business goals. However, the most important is how you conduct initial research on key metrics that define the profitability of your short-term rentals.